They would like you to assume that itâs over, that the brand new facility that the Fed magically created. They would like you to assume that that has mounted the whole lot. However all they ever do is trade the way in which they account for issues. And what actually occurs is the device will get extra susceptible as a result of this entire factor hinges on whether or not or no longer you imagine their lies. And you return right here. Iâm telling you the reality. And no longer handiest am I telling you the reality, however Iâm supplying you with the gear to do your personal due diligence. Donât take my phrase for anything else, however donât take theirs. As a result of while you do this, you permit the whole lot susceptible and uncovered. And Iâm going to show the reality. And Iâm going that will help you no longer be susceptible.

CHAPTERS:

0:00 Advent

1:52 SVB Steadiness-Sheet

6:55 CEO Inventory Selloff

10:00 20 Banks Attainable Securities Losses

18:00 FDIC Banking Profile 2019-2022

22:08 Gold Premiums

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

They would like you to assume that itâs over, that the brand new facility that the Fed magically created, they would like you to assume that that has mounted the whole lot. However all they ever do is trade the way in which they account for issues. And what actually occurs is the device will get extra susceptible as a result of this entire factor hinges on whether or not or no longer you imagine their lies. Whilst you come right here, Iâm telling you the reality. And no longer handiest am I telling you the reality, however Iâm supplying you with the gear to do your personal due diligence. Donât take my phrase for anything else, however donât take theirs as a result of while you do this, you permit the whole lot susceptible and uncovered. However Iâm gonna divulge the reality and Iâm gonna mean you can no longer be susceptible bobbing up.

Iâm Lynette Zang, Leader Marketplace Analyst right here at ITM Buying and selling, and I’m doing what I’ve been put on the planet to do and Iâm getting chills already. And what I need you to grasp is donât imagine the lies. This can be a setup. Are they gonna lose keep watch over of this? Neatly, whatâs going to decide that’s the self belief that the general public provides the Fed. And a large number of individuals are nonetheless no longer paying consideration. So if they are able to make those markets bounce, if they are able to make those markets appear calm, then the general public that arenât paying consideration anyway won’t ever perceive the shift that simply came about or the time bomb that weâre sitting on. Letâs pass proper to it then.

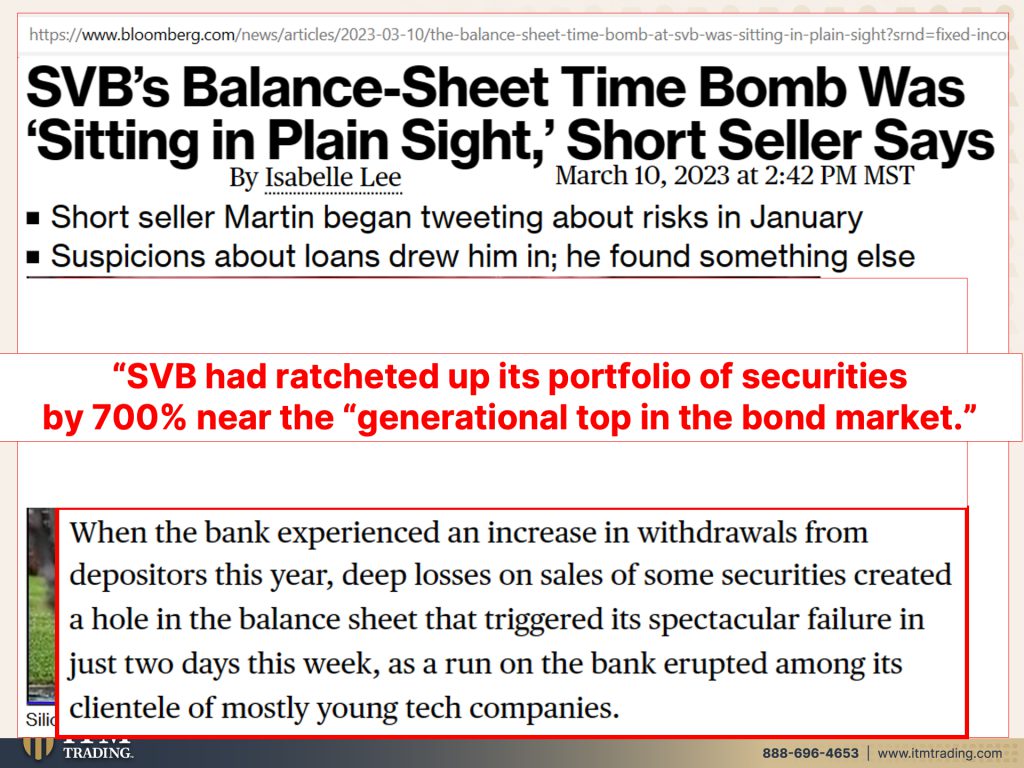

As a result of SVBs steadiness sheet time bomb was once sitting in simple sight. However the fact is, is that theyâre no longer the one ones as a result of after greater than a decade of 0 rate of interest coverage and loosening up of investor protections through the years, I imply this is similar sport that performs out over and again and again imply again within the disaster with the NASDAQ disaster in 2000. After which what came about in 2001, 9/11/2001. Ok, smartly we had been utterly arrange for some other inflationary dash, however the issue is, and the similar factor, , and thatâs what ended in what came about in 2008 with the derivatives bubble. I imply it popped in 98, what longer term capital control after which it popped once more in 2007 with the subprime debacle and it’ll pop for a 3rd time. I donât assume they’ve some other inflationary push in there. I believe they’ve used the whole lot up and we all know that as a result of theyâve been anchored at 0 and so theyâre looking to elevate it after which one thing breaks. After all it does. The entire banks steadiness sheets are riddled and full of, with bonds and loan basket securities and debt this is at tremendous low ranges someplace close to 0. Weâre no longer in a nil rate of interest coverage atmosphere anymore, despite the fact that they may drop it down.

However even supposing they do return to 0, is that gonna repair this drawback? No. We need to transition into a brand new device and possibly this, possibly SVB came about faster than they’d expected. And I am hoping this presentations you that those guys aren’t gods. Theyâre human beings and so they reside in an ivory tower. No longer in the actual global. In the actual global. There are millions of currencies that don’t exist, can’t purchase you anything else anymore, together with a few of the ones of the USA. I imply those are all from the USA. So is that this, we donât take into accounts that, however we must as a result of our buck, I donât actually have a present buck in right here thatâs no longer frankly ripped up. This one goes the way in which of the others as smartly. However let me display you this, ok?

As a result of SVB had ratcheted up its portfolio of securities by means of 700%. Close to the generational best within the bond marketplace. In different phrases, take into accout rates of interest, theory worth of bonds. So when the ones rates of interest had been down at 0, they had been purchasing those very pricey bonds, they’d ratcheted up their portfolio 700%. That is the succeed in for yield. And what theyâre actually doing is risking your theory for a bit pickup in hobby. Why would you do this? To me, that is unnecessary. Those are very dangerous operations. And when the financial institution skilled an build up in withdrawals from depositors this 12 months, deep losses on gross sales of one of the vital securities created a hollow within the steadiness sheet that brought about its impressive failure. In simply two days. As a run at the financial institution erupted amongst its clientele of most commonly younger tech corporations, they are able toât find the money for a run at the banks. Thatâs why again in 2020 you had these kind of central bankers trot out and let you know, donât fear motive we will simply, you donât have to fret about earning profits, we will simply pass forward and print as a lot cash as we wish to fulfill your whole money withdrawals. However each and every time they do this, the worth of whatâs already in the market is going down. So that they created this facility in order that you so additional hidden from you is that this time bomb on financial institution steadiness sheets additional hidden from you. And theyâre gonna say this isn’t a bailout excluding for one large large factor. And that’s it’s the taxpayer this is in the end accountable for any cash, any new cash this is created by means of the central financial institution, by means of the federal government. So it’s certainly a bailout. They simply wanna tweak it, but it surely doesnât subject. A rose by means of some other identify continues to be a rose.

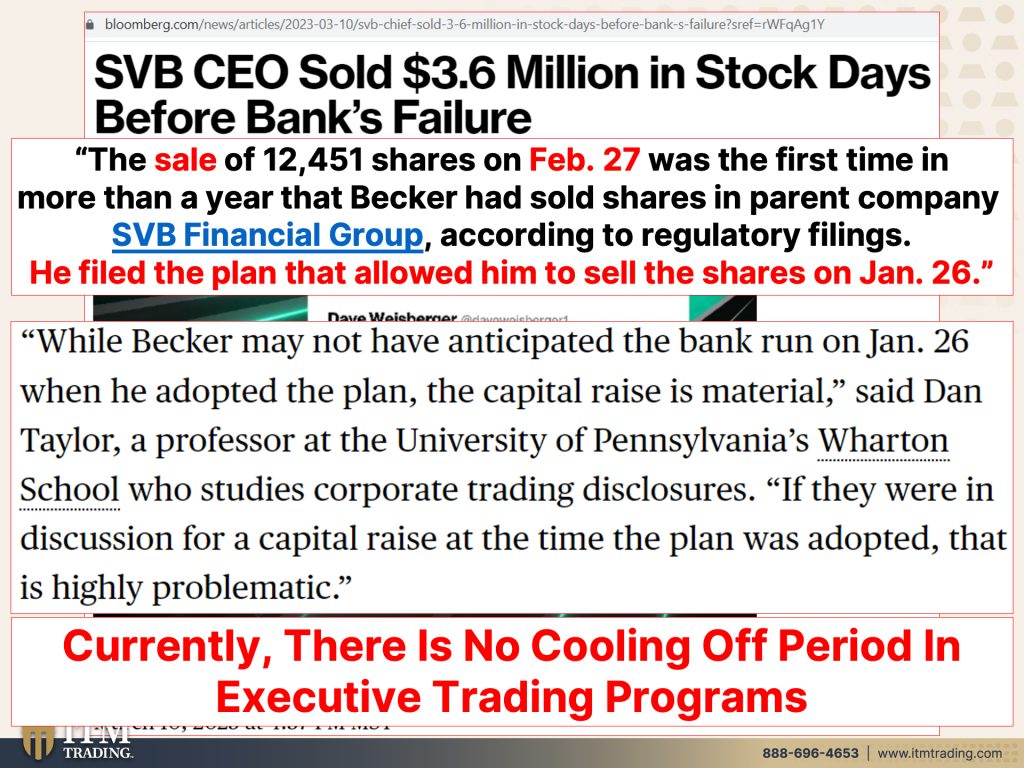

And do you assume that he would possibly have identified again in January that he was once operating into doable issues? Do you assume that those guys donât know how overleverage they’re? However additionally they are counting at the central financial institution having their again. Does the central financial institution have the personâs again? No, they donât. They have got the banks again. This is their task. The overall economic system isn’t actually their task. Sure, they would like value balance. However thatâs in order that you and I donât ask for more cash once weâre negotiating our wages in order that we donât look forward to upper inflation, which by means of the way in which got here in and oh my goodness, itâs sticky that means that inflation is right here to stick and now the Fed is between a rock and a troublesome position. Giant time evident as a result of weâll see what theyâre gonna do so far as elevating charges and yeah, thisâll pop out on Thursday. So we might or would possibly not have that. I donât assume weâre gonna have that solution moderately by means of then. However , are they gonna elevate charges 25 foundation issues simply to turn us that theyâre gonna stay elevating? The sale of 12,451 stocks on February twenty seventh was once the primary time in additional than a 12 months that Becker had bought stocks in guardian corporate SVB monetary workforce in line with regulatory filings, he filed the plan to that allowed him to promote the stocks on January twenty sixth. Hmm. Isnât that fascinating, whilst Becker would possibly not have expected the financial institution run on January twenty sixth when he followed the plan, the capital elevate is subject matter as a result of, and the capital elevate was once what the financial institution introduced that they had to elevate extra capital. So the capital raises subject matter blah blah blah. In the event that they had been in dialogue for a capital elevate on the time the plan was once followed, this is extremely problematic. In different phrases, he was once buying and selling on insider data. Weâll see what this proves. However you wanna know the reality? I donât agree with any of it. I simply donât. Iâm sorry. You wanna know what? I agree with bodily metals in my ownership. Thatâs what I agree with these days. Thereâs no cooling off length in government buying and selling methods Now that this is converting. And curiously sufficient, thatâs converting on April 1st, which I believe is actually fascinating. However that implies that as soon as he filed that, that plan that allowed him to promote his stocks, he may promote them anytime. He will have bought them day after today, however that mightâve been too evident. So he bought them a month later. Hmm. What do you assume he knew that you simply didnât know?

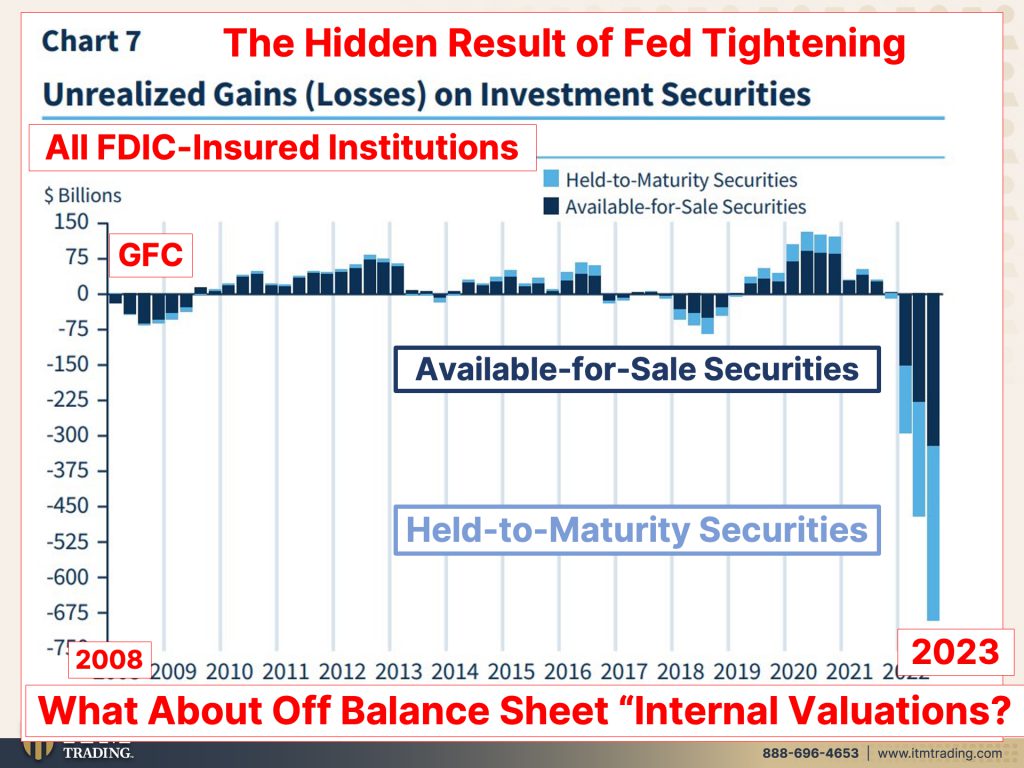

Neatly, wager what? 20 banks are sitting on large doable safety losses as was once SVB. However Iâm gonna let you know, and Iâm gonna pass into this in additional element subsequent week, however they, itâs no longer simply 20 banks, itâs the entire banks and they’re sitting on large losses. And within the derivatives area, that opaque area, itâs gotta be actually, actually unhealthy. This might be the Black Swan match, this might be the Lehman second. If they are able to calm everyone down and the general public doesnât understand, the general public simply more or less is going about their trade. I imply it was once fascinating. Iâm going in the market. Most of the people aren’t acutely aware of what simply came about to SVB financial institution. That is helping them, that is helping the central financial institution. That is helping the federal government as a result of theyâve gotta stay your self belief. There are many different banks that might face large losses in the event that they had been pressured to offload securities to boost money. So that theyâve were given to steer clear of the ones financial institution runs as a result of thatâs when this turns into evident. Higher to arrange that that new facility the place you receivedât need to take losses to your money on promote your, your, your losses into the marketplace. No, simply convey them right here. And the Federal Reserve the usage of taxpayer again greenbacks, whether or not they say that brazenly or no longer, motive they donât need you to comprehend this isn’t a bail-in, this isn’t a bail-in, weâre no longer the usage of taxpayer greenbacks. Thatâs rubbish. You and I taxpayers backstop the ones steadiness sheets. However convey your underneath underwater securities and weâll can help you borrow as though theyâre at 100%. How about you are taking your portfolio out of your shares which might be underwater and pass to JP Morgan and say, smartly, , I paid this for âem and yeah, theyâre right here now, however I need you to mortgage me cash according to that. Do you assume JP Morgan would do this? Iâm pondering, no longer frankly, however simply what are the ones unrealized losses on securities? And I’m gonna be a bit redundant as a result of clearly this week approaching air greater than I expected. However let me disclose to you what unrealized losses on securities are. Banks leverage their capital, your deposits by means of accumulating deposits or borrowing cash both to lend the cash out to buy securities. So buying and selling <snigger>, ok? They earn the unfold between their reasonable yield on loans and investments of their reasonable price of price range. So no matter theyâre paying you. And everyone knows that even if rates of interest were going up, itâs only recently the banks have began to extend what theyâre paying you. However once more, Iâm gonna return to you and say, why would you possibility your theory for a bit little bit of hobby? Itâs no longer value it. Even though theyâre paying, smartly, theyâre no longer paying you 5%, however even supposing they had been, why would you possibility your theory for that? To be had on the market may also be bought anytime and the ones are marked to marketplace. So in different phrases, anyplace the banks, anyplace the present marketplace worth of the ones securities are up or down, ok? Theyâre gonna be marked to marketplace. So these kind of laws are almost definitely gonna be converting now too. Held to adulthood aren’t marked to marketplace so they are able to grasp them at par worth whether or not theyâre upper or decrease within the present marketplace value. I confirmed you this graph the previous day, Iâm gonna display it to you once more as a result of those are actually the hidden results of the Fed tightening even at the Federal reserves steadiness sheet the place theyâve been purchasing large quantities of loan sponsored securities, large quantity of treasuries. And weâve been speaking concerning the loss of liquidity in those markets that has been erupting since 2015. So none of it is a large wonder, but it surely must all be telling you if this isnât the Lehman second, weâre close to one. Weâre very, very, very close to one. So once more, should you didnât see the previous day, those are all FDIC insured establishments. Those aren’t simply SVB or small regional banks. Those are all insured establishments. Right hereâs 2008 within the nice monetary disaster. You’ll be able to see what that appears like. Now, they’d much more securities on the market. They werenât this little blue house. The lighter blue are held to adulthood, proper? So banks had been pressured to position up their securities on the market. Now right here we’re in 2023, thereâs your to be had securities on the market. Beautiful vital drop, far more than came about. What came about in 20 in 2008? And they would like us to assume that that is not anything like 2008. Wager what?

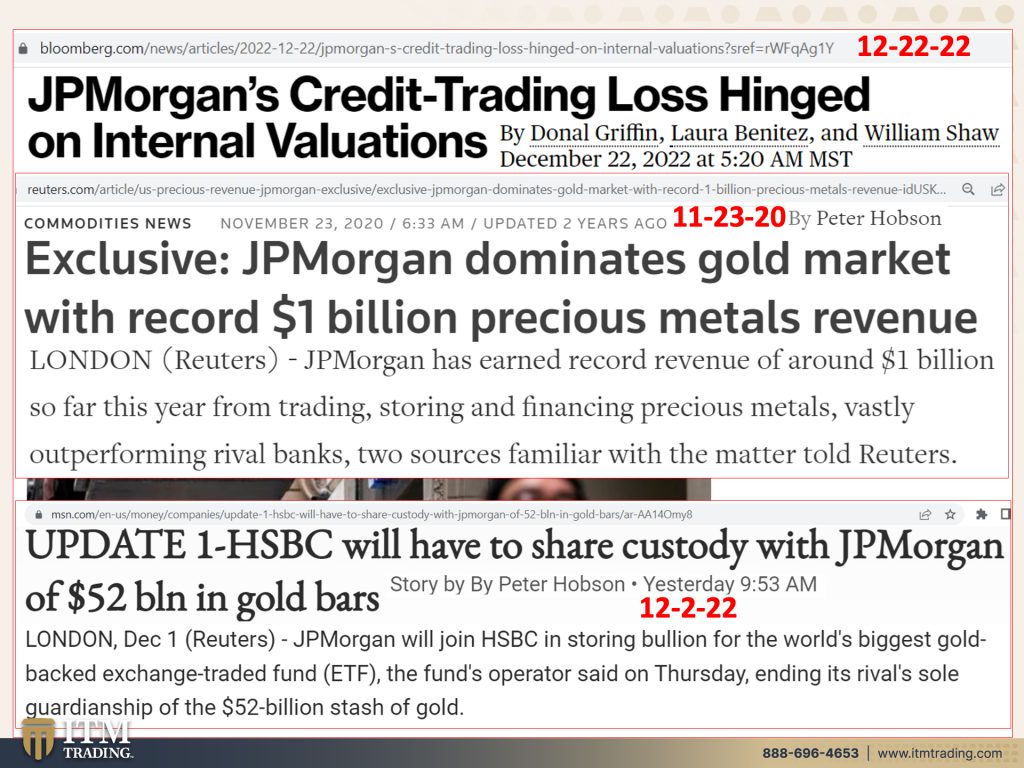

2008 was once when the device died and it went on existence strengthen of all of this cash, loose cash printing. And it reinflated the entire fiat cash property, shares, bonds, actual property to stay the ones derivatives afloat. Make no mistake about what theyâre doing right here. Donât glance at the back of the curtain. You simply, simply simply have weâve were given it. You donât have to fret a few factor. Weâve were given it underneath keep watch over actually? As a result of there are such a large amount of off steadiness sheet and interior valuations. How do you actually know what that point bomb is? I imply chances are you’ll take into accout this JP Morganâs credit score buying and selling loss hinged on interior valuation. A few of the ones valuations raised eyebrows within the broader marketplace. You assume, you assume? That was once simply again in December, no longer that way back, however again in 2020, what did JP Morgan additionally do? They dominate the gold marketplace with a file of billion treasured metals income thatâs buying and selling. Through the way in which, thatâs no longer purchasing and grasp me after I purchase it. I grasp it JP Morgan. Howdy, it is advisable create a limiteless quantity of the ones, of the ones contracts thatâs buying and selling income. Donât you’re keen on that? Buying and selling, storing and financing treasured metals massively outperforming rival banks. Now additionally ultimate December, they HSBC financial institution has to proportion custody with JP Morgan of 52 billion in gold bars. And those are the sorts of bars that again change traded price range, ETFs. So GLD there, there are a variety of them in the market which might be that, which might be held by means of HSBC and JP Morgan. Theyâre those by means of the way in which, that experience get entry to to that gold. You if you are going to buy an ETF, you simply personal a proportion in a agree with. And that agree with is designed in particular, and weâre gonna come again to this, however is designed in particular to reflect the or to move with precisely the industry of the spot marketplace. So they only need to seem like the spot marketplace all of the whilst promoting off holdings to pay all their charges, however theyâre those that experience get entry to.

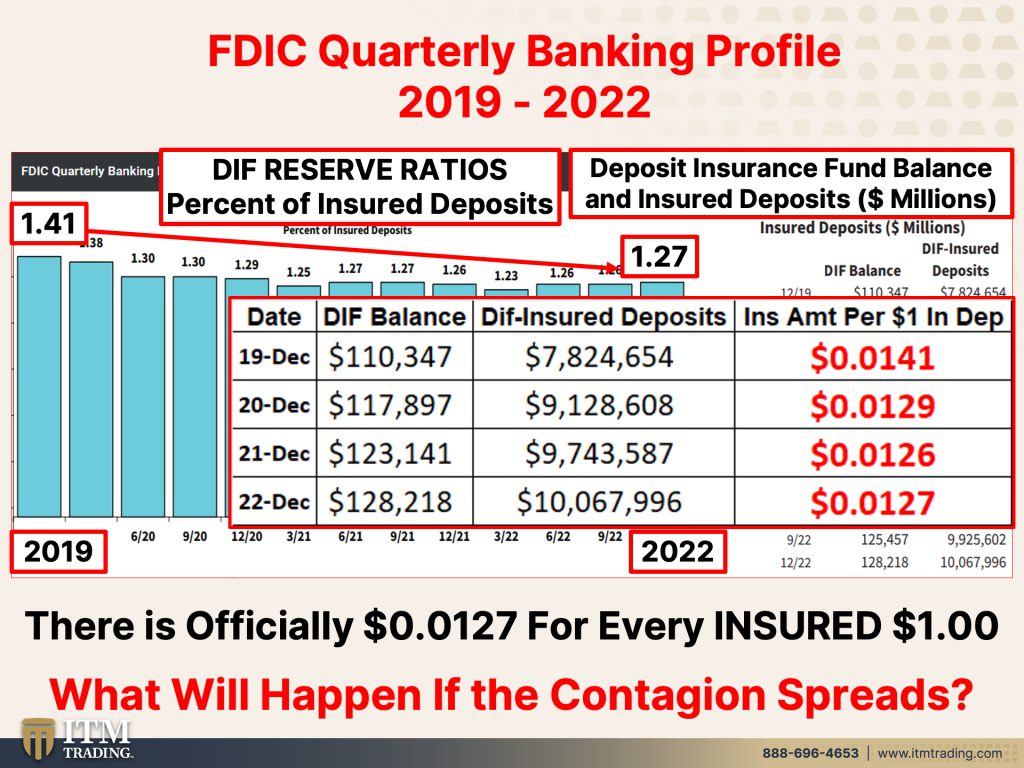

I additionally confirmed you this one the previous day and I actually really feel either one of those surely or Monday I confirmed this to you. It, it’s value repeating. That is the DIF reserve ratios. Those are the % of insured deposits. So that is from the FDIC. Their most present is going during the finish of 1222. And as you’ll see again in 2019, which is some distance way back to this bar chart is going, they’d 1.41% out of 100% to verify deposits. Having a look at 2022 thatâs long gone down. They now have 1.27% to verify 100% of insured deposits. Now, what we all know is that the movements that the Fed took and the federal government has taken in order that you donât panic, you donât pass and take cash outta your financial institution, is that they’re now going to backstop and make sure 100% of the entire deposits which might be in the market. Oh excellent, smartly how a lot is there in there anyway, if we pass all the way down to right here, which is December twenty second, there was once 128.218 billion to verify many trillions of all deposits. So that they higher no longer have to any extent further financial institution runs as a result of this may occasionally completely crush that device. And everyone would know the emperor isn’t dressed in any garments or even of the deposits which might be insured, smartly, so long as a complete bunch of banks donât pass out without delay, I suppose weâre ok, however they simply have slightly greater than a penny to verify your buck. And the way lengthy is that 100% backing gonna be after they did it in 2008, they went from 100 thousand to $250K. Neatly thatâs caught. Is that what theyâre gonna attempt to do now? And by means of the way in which, what theyâre announcing and the explanation why theyâre announcing that this isn’t going to this isn’t a bail-in as it doesnât as a result of taxpayers aren’t gonna pay for it. Their concept is, is theyâre going to levy particular taxes to banks to building up that DIF fund. Thatâs what they do in a disaster. Neatly wager what? Banks arenât gonna have the ability to backstop all of that. And by means of the way in which, what does that imply for you at your financial institution? Theyâre going to extend the prices. Now possibly they receivedât ship you a invoice at once, despite the fact that you for sure get a right away invoice for plenty of issues. However what additionally they can do is disguise the ones prices. So identical to they havenât been elevating charges, that implies extra earnings for the banks as a result of whats up the ones banks, any reserves that they’ve parked on the Fed, theyâre making a complete lot more cash on that. Theyâre no longer paying you anymore. Simply one thing to pay attention to. So if this contagion spreads, we’re in deep doo-doo and it will be able to crush the federal reserve and the entire device. However donât fear a few factor motive in the end treasury secretary Yellen says, financial institution device stays resilient within the wake of this failure. Neatly, subsequent week Iâm gonna do a deeper dive into how we were given up to now. So endure with me on that one. Thereâs handiest such a lot of hours of the day and Iâve been running maximum of them. However are you able to see why public self belief is so important? Itâs whatâs preserving the entire thing in combination.

And letâs check out whatâs taking place with the premiums on simply between spot gold and the gold eagles and the spot gold is the gold colour of which they are able to create as many as they would like. After which you’ll see the top class. And this is going again to 2017. And so you’ll see right here the top class was once no longer that groovy, however take a look at what came about. That is 2020. You’ll be able to see what came about in 2020. We were given the top class all within the premiums more or less got here down. However take a look at the place the premiums at the moment are. Why? As a result of actual call for of the bodily steel has outstripped the supply. Itâs simply that easy within the bodily marketplace that may be a true provide and insist equation. A real one. Within the paper marketplace they are able to create up to they would like. And so what they’ve to do since a emerging gold value, is indication of a circle of relatives foreign money is they’ve to suppress it. That they are able to simply suppress it’s just by developing as a lot gold and silver that doesn’t nor ever will exist. Thatâs the way in which that they are able to simply suppress it. However you’ll see the ones premiums on gold eagles are rising increasingly more and extra. Now, for my part, and I need you to listen to me in this, however a large number of instances other folks donât. However for my part I don’t purchase gold eagles. Why? As a result of my historical past is going again lengthy sufficient to after I keep in mind that gold, I donât take into accout the true confiscation, however I do know I used to be born in 1954 and it was once unlawful to carry greater than 5 oz. of gold some other manner than in, than within the pre-1933 cash. And I noticed my Uncle Al with no less than 3000 cash in the ones safes minimal. And he had all of them legally. And I wanna even have the type of gold. Doesnât subject whether or not Iâm proper or whether or not Iâm flawed, however letâs check out what’s these days taking place within the bodily on this marketplace. Ok? motive thatâs what youâre taking a look at right here. Neatly that too has been going up a complete lot greater than what you notice taking place up right here within the spot marketplace, which is that it helps to keep bumping its head and it’ll pass upper, itâll destroy thru. However within the bodily handiest global, itâs already had that step forward. And that is the only for extremely rarities, which is much more dramatic than this stage of coin since the extremely rarities, gosh, they opt for like hundreds of thousands and hundreds of thousands of greenbacks for one ounce of gold. In order a reminder, the spot marketplaceâs a limiteless selection of contracts. The the ultimate that they reported it earlier than they modified the accounting laws for each and every one ounce of bodily gold, there have been 62,000 oz. of paper gold in line with the financial institution for global settlements. Iâm certain thatâs a lot upper now. However within the bodily global as a real purchase promote marketplace, there’s a restricted quantity. So it’s extra reflective. However those premiums up right here must display you whatâs in truth actually taking place within the markets irrespective of how they set up to control them. How repeatedly coop are you able to be lied to and also you have no idea the reality each and every unmarried time, however I donât need you to be lied to. And Iâm lovely certain you donât wanna be lied to as a result of lack of knowledge does no longer make you immune. It simply leaves you susceptible.

So I need you to stick tuned and return. For those who havenât watched all of the paintings Iâve finished at the SVB cave in, return and watch these kind of movies ranging from ultimate Friday, nearly every week in the past. Through the way in which. We additionally introduced a brand new Spanish channel. You wanna be sure to watch that and to proportion . Weâll be doing a reside version of it. Neatly we simply did a reside version of it the previous day. And the place we simply more or less destroy it down and Fernando asks me questions. So itâs a actually quick and possibly a great way so that you can proportion with your pals. They donât have to talk Spanish, itâs in each languages. And likewise just remember to pass to <snigger>. This hasn’t ever been extra essential than it’s at this time motive whatâs the chant? Meals, Water, Power, Safety, Barterability, Wealth Preservation, Neighborhood and Safe haven. And I’m going over the ones issues each and every Monday on Mantra Mondays and you’ll in finding all of that on Past Gold and Silver as a result of whilst that is your basis and also youâve gotta get it set and also youâve gotta get it proper motive that is actual cash, you want all of the ones different issues to take care of a cheap lifestyle. So should you havenât finished so but, just remember to subscribe and in addition click on that Calendly hyperlink under and get your plan in position and begin to execute ASAP. Go away us a remark, give us a thumbs up and proportion, proportion, proportion. And take into accout, monetary shields. Theyâre manufactured from steel. Certainly no longer paper and guarantees. Oh, I want theyâd run out, Which can be managed by means of other folks, that theyâre no longer your pals. And till subsequent we meet, please be protected in the market. Bye-Bye.

SOURCES:

SVBâs Steadiness-Sheet Time Bomb Was once âSitting in Simple Sightâ (SIVB) â Bloomberg

20 banks which might be sitting on large doable securities lossesâas was once SVB â MarketWatch

https://www.fdic.gov/research/quarterly-banking-profile/qbp/2022dec/qbp.pdf#web page=1

https://www.fdic.gov/assets/resolutions/bank-failures/failed-bank-list/

https://www.pcgs.com/costs/coin-index/key-dates-and-rarities